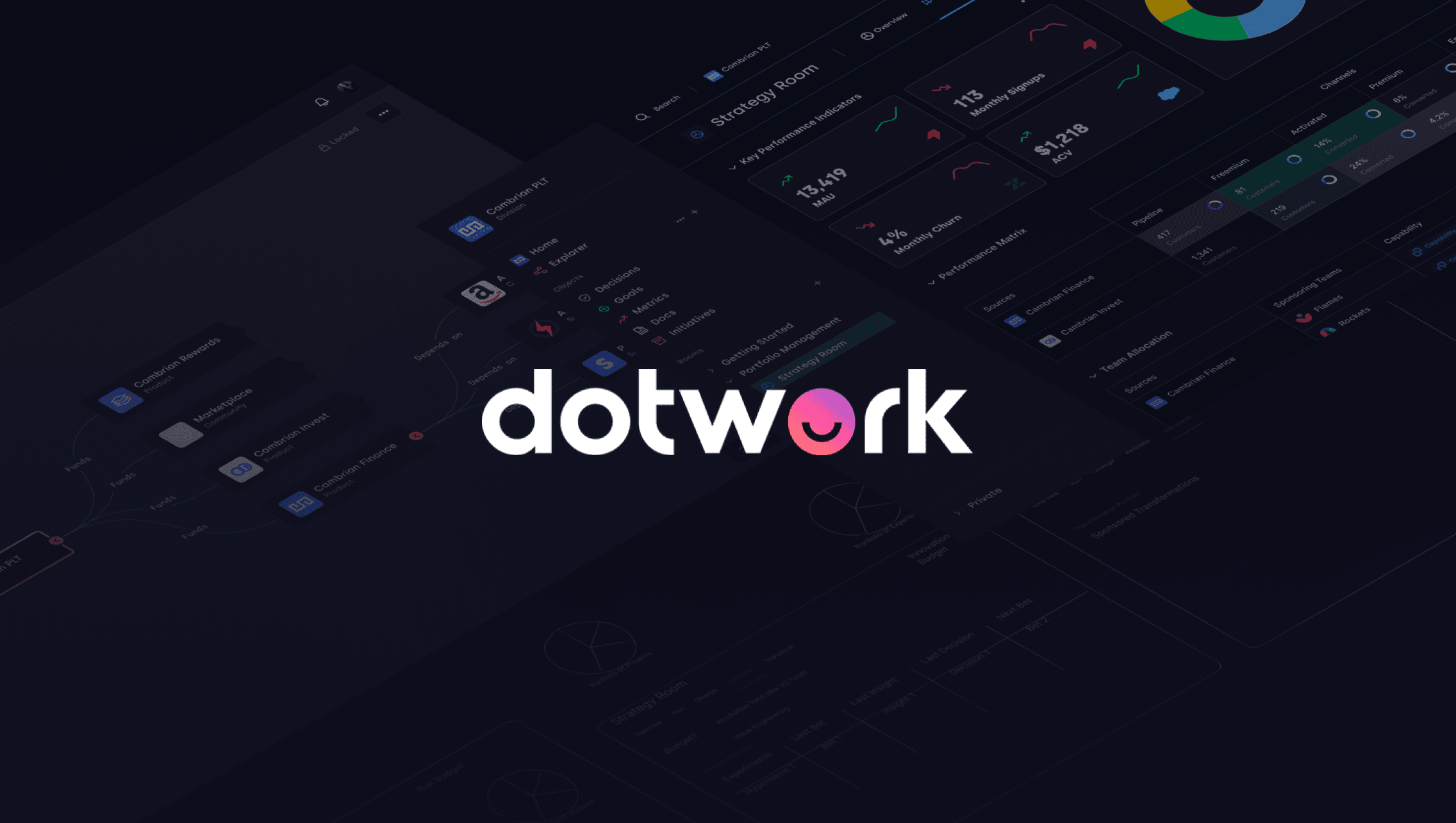

Writing about the ways we work

Covering topics on operationalizing strategy development, planning, and alignment; including new ideas on practices, techniques, reports, and visualizations.

We focused on hard, boring problems; and accidentally became an AI company.

Why platforms are the real force-multiplier with AI

Eliminate Data Entry, Not Strategic Context

Today, we’re announcing major AI capabilities that extend Dotwork’s role as the enterprise operating system for humans and AI agents alike

Bring Your Version of SAFe to Life

We’re thrilled to announce that Dotwork will release our reference architecture for the Scaled Agile Framework (SAFe) this September. This addition to our Dotpack Library will be available for demo with customers and partners at the SAFe Summit in Denver.

Faster Tech, Slower Systems

Why AI Demands a New Operating Model

How Operations Can Prepare for Continuous Transformation

Operations leaders face constant change, shifting realities, and persistent challenges. Success depends on balancing order and chaos, adapting systems, and enabling momentum—knowing there’s never a final state.

Thriving During The Great Flattening

We’re in the middle of the Great Flattening. Fewer layers, more hands-on leaders, and a push to do more with less. Teams are juggling AI, innovation, and efficiency all at once. It's like asking a race car driver to win the race while saving fuel. How can leaders navigate the competing tensions and still move their teams forward? And how should you adapt your operating system to meet the moment, without jeopardizing future impact?

The 4 Prioritization Jobs (And Why It Matters)

Most prioritization discussions are a messy mix of four distinct jobs: improving efficiency, maximizing leverage, enabling autonomy, and securing support. When teams conflate these, they talk past each other and get stuck. Clarity comes from naming which job you're tackling—and sequencing the conversations to match your context.

Patterns of Decision Architecture

Organizational behaviors that improve decision quality

20 Connected Dots

Exploring the 'types' of dots across an organization

© 2025-2026 Dotwork, Inc. All rights reserved.